Market value of bond calculator

The algorithm behind this bond price calculator is based on the formula explained in the following rows. On this page is a bond convexity calculator.

How To Calculate Carrying Value Of A Bond With Pictures Cpa Exam Bond Raising Capital

Ad Build a resilient portfolio with Morningstar Investors independent bond research.

. N 1 for. It will compute a bonds convexity as the second derivative of the bonds price in relation to the interest rate. Add the bonds present lump sum value of 62090 and the present value of its interest payments 39927 for a total of 102017.

Our Resources Can Help You Decide Between Taxable Vs. Since the coupon rate is lower than the YTM the bond. The Bond price calculator results - more insight.

Looking for a low cost surety bond. To calculate the coupon per period you will need two inputs namely the coupon rate and frequency. Figure the Market Value of Bonds.

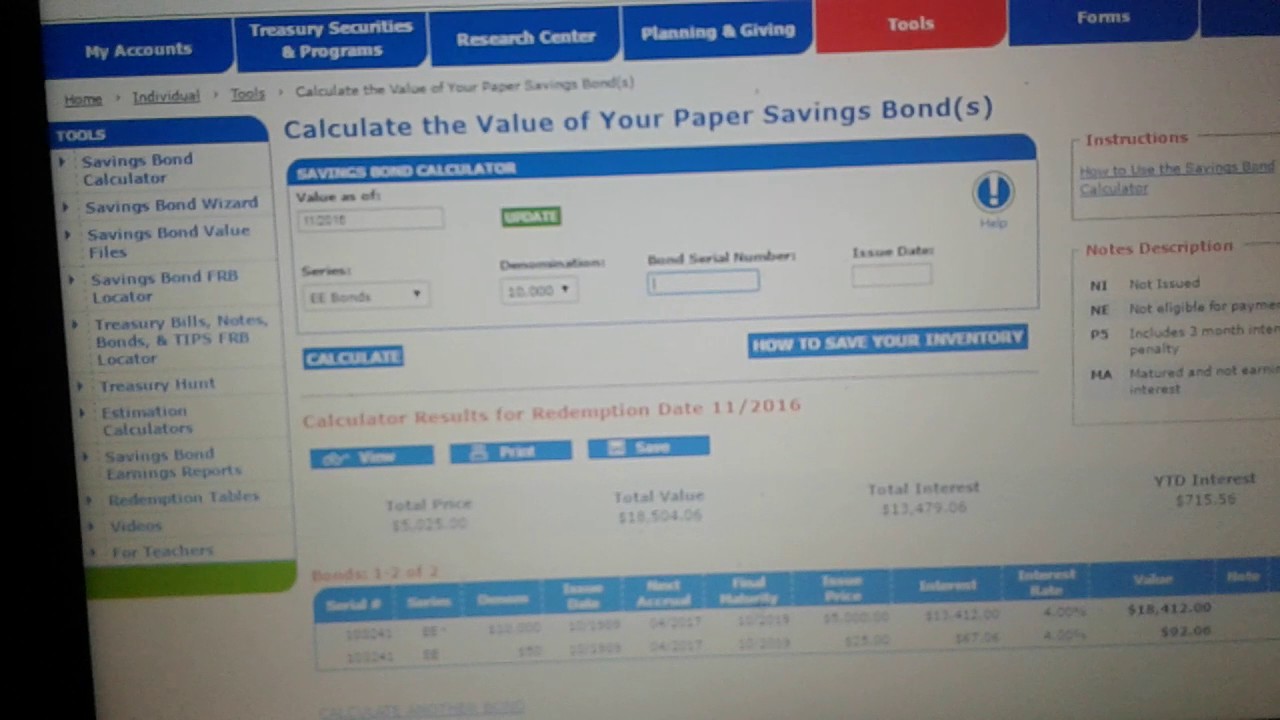

Annual coupon rate is 6. The Savings Bond Calculator WILL. The calculator uses the following formulas to compute the present value of a bond.

How to Calculate Bond Price. N Coupon rate compounding freq. It can be calculated using the following formula.

Bonds are one of the most important investment options youll find within the broader securities community. This is the nominal annual rate paid for bonds of the same type at the time the bond was issued. Here are some insights that we would like to share.

Ad Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income. Initial market rate This is the nominal annual rate paid for bonds of the same type at the time the bond was issued. Bond price - while bonds are usually issued at par they are available in the resale market at either a premium or a discount.

This is used to calculate the current value of the bond if the rate remained at. Ad In need of a quick and easy surety bond at a low rate. Bond face value is 1000.

Enter the current market rate that a similar bond is selling for only numeric characters 0-9 and a decimal point no percent sign. To use our free Bond Valuation Calculator just enter in the bond. The Calculator will price paper bonds of these series.

Calculate the value of a paper bond based on the series denomination and issue date entered. How to Use the Bond Calculator Your inputs. This makes calculating the yield to maturity of a zero coupon bond straight-forward.

If a bond is quoted at. Present Value Paid at Maturity Face Value Market Rate 100 Number Payments. To Hold or to Sell.

Our free online Bond Valuation Calculator makes it easy to calculate the market value of a bond. If the current market rate is below the coupon rate then the. The price of the bond calculation using the above formula as Bond price 8387862.

This calculator enables you to compare the reaction of two bonds to changes in the prevailing rate of return in the bond market. To calculate a value you dont need to enter a serial. You can easily calculate the bond price using the Bond Price Calculator.

Contact a UFG Insurance agent today. Look no further UFG Insurance has you covered. The future value calculator can be used to calculate the future value FV of an investment with given inputs of compounding periods N interestyield rate IY starting amount and periodic.

What is the bond price. Optionally it will show the price. C Coupon rate.

In fact while speculative securitieslike. Explore high-yield bond funds in the fixed-income market with a 7 day free trial. Now you know the meaning of bond prices and how to calculate them.

You can use the calculator to see how your bonds price will change to reflect changes in the yield to. Lets take the following bond as an example. This is used to calculate the current value of the bond if the rate remained at.

F Facepar value. Calculate Bond Price if Rates Change. C 7 100000 7000.

Bond prices fluctuate when interest rates change. Coupon per period face. EE E I and savings notes.

Find out what your paper savings bonds are worth with our online Calculator.

Bond Yield Calculator Online And Free Www Investingcalc Bond Yield Calculator Free Coupon Rate Current Yield Investing Money How To Get Rich Bond

How To Calculate Value At Risk Var In Excel Investing Standard Deviation Understanding

Models For Calculating Cost Of Equity Accounting Books Equity Accounting And Finance

Uneven Cash Flow Streams Mgt232 Lecture In Hindi Urdu 07 Youtube Lecture Business Finance Amortization Schedule

Free Online Altman Z Score Calculator At Www Investingcalc How To Get Rich Investing Money Investing

Bond Price Calculator Online Financial Calculator To Calculate Pricing Valuation Of Bond Based Financial Calculator Financial Calculators Price Calculator

Pin On Ch 4 Bond Valuation

Solved Sincere Stationery Corporation Solutionzip Solutions Corporate Solving

How To Calculate Diluted Eps Financial Analysis Basic Concepts Financial

How To Calculate Rate Of Return On Maturity From A Money Back Life Insurance Policy Life Insurance Policy Credit Card App Insurance Money

Finding Your Treasury Direct Bond On The Calculator Bond Birth Certificate Statement Template

Bond Value Calculator Used To Track Price Of Any Bond Corporate Bonds Bond Market Debt Capital Markets

1

1

How To Create Your Personal Net Worth Statement And Why You Need It Personal Financial Statement Finance Saving Budgeting Money

Pin On Forex Signals

3